No commissions | Fee-based advice

Tactical investing with a human touch

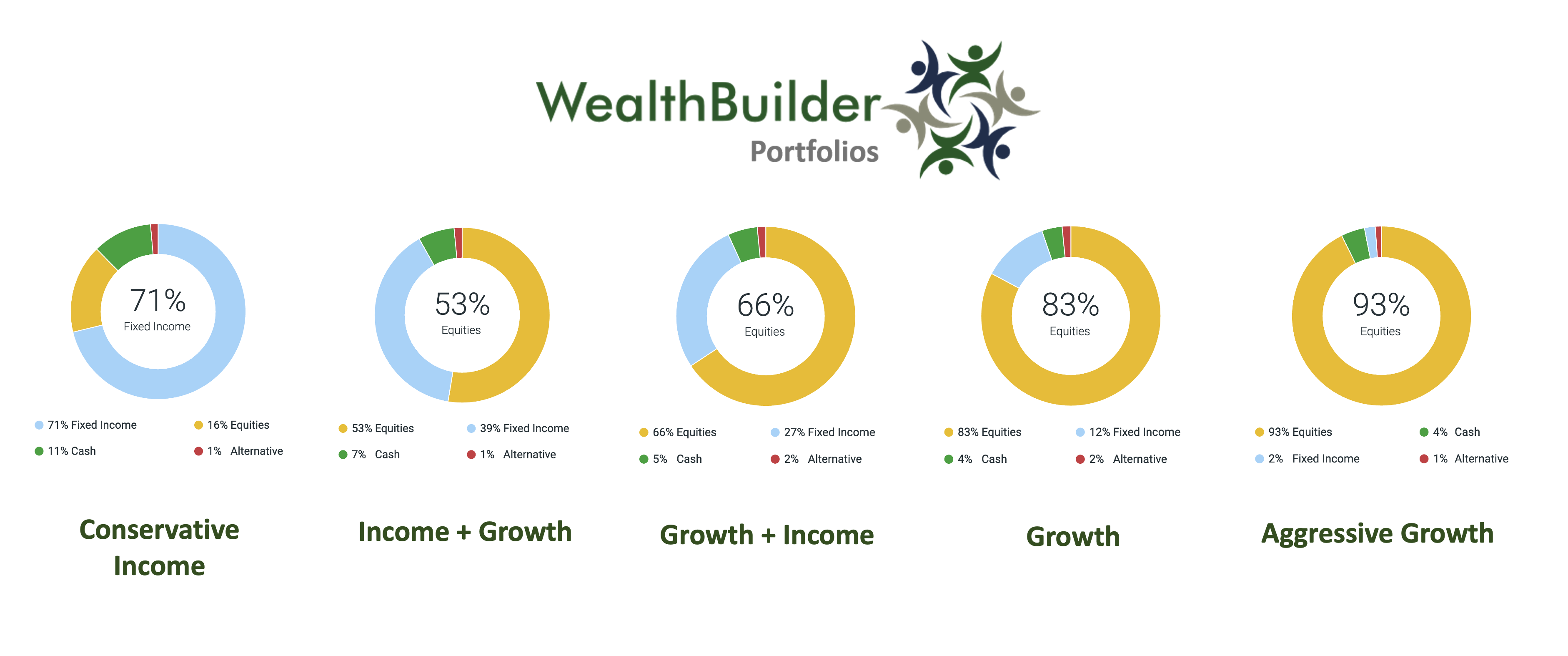

WealthBuilder Investing offers turnkey investment solutions to help you reach your financial goals.

+1.844.672.7623

OUR SERVICES

Flexible and easy-to-use platform

Simplify your investment experience

Paperless account opening

Paperless account opening and transfers with just a few clicks

01

Auto deposits and transfers

Automate your investment contributions and transfers from your external accounts

02

No fees to buy and sell

No additional fees to buy or sell securities in your portfolio

03

04

Portfolio rebalancing

We rebalance your portfolio at no additional cost to you

TESTIMONIALS

What clients say about us

*Testimonials were provided by current clients at the time of their respective testimonials. The client was not compensated, nor are there material conflicts of interest that would affect the given statement. The statement may not be representative of the experience of other current clients and does not provide a guarantee of future performance, success or similar services. The client testimonials presented were chosen by the firm, other clients may have different experiences.

OUR FEES

Annual fee range 0.40% – 2.00%

- Dedicated account representative 100%

- Asset allocation / portfolio construction advice for investments under management 100%

- 401k / 403B investment advice and trading through RetirementBuilder service 100%

- Periodical meetings/check-ins 100%